how to calculate my paycheck in michigan

Michigan Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Up to 25 of your disposable earnings OR The amount of your disposable earnings thats more than 30 times the federal minimum wage currently 21750 a week Read the article An.

Michigan Property Tax H R Block

25 of your weekly disposable earnings your gross wages minus legally.

. This differs from some states which tax supplemental wages like bonuses at a different rate. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

For 2022 the wage base limit for social security contributions is 147000. Well do the math for youall you need to do is enter. This free easy to use payroll calculator will calculate your take home pay.

Generally speaking in Michigan creditors can garnish the lesser of the following in any given workweek. For example if an employee earns 1500 per week the individuals annual. The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the percentage of your salary that.

This calculator can determine overtime wages as well as calculate the total. SOM - State of Michigan. To use our Michigan Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Michigan. The latest budget information from April 2022 is used to. Calculating your Maryland state income tax is similar to the steps we listed on our Federal paycheck calculator.

The tax pays for federal unemployment benefits. Medicare contributions do not have any maximum cap on applicable income. Figure out your filing status work out your adjusted gross income.

Michigan Income Tax Calculator 2021. In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same flat rate of 425. Supports hourly salary income and multiple pay frequencies.

Additionally high income earners above. After a few seconds. Using our Michigan Salary Tax Calculator.

If you make 70000 a year living in the region of Michigan USA you will be taxed 11154. This should include all wages that an employee has. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Michigan. Calculating your Michigan state income tax is similar to the steps we listed on our Federal paycheck calculator. The law governing paycheck distribution frequency in Michigan which is the Payment of Wages and Fringe Benefits Act applies to both salaried employees and hourly.

How You Can Affect Your Michigan Paycheck. The rate is 6 of the first 7000 of taxable income an employee earns annually. Salary Paycheck Calculator Michigan Paycheck Calculator Use ADPs Michigan Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Note a huge caveat that you can claim a tax credit. Wherever you live in Michigan if you resign from your employer the final paycheck should be paid no later than the next scheduled payday. Figure out your filing status work out your adjusted gross income.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Michigan. Your average tax rate is 1198 and your marginal.

Simply enter their federal and state W-4 information as.

Michigan Hourly Paycheck Calculator Gusto

Best Cheap Health Insurance In Michigan 2022 Valuepenguin

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Michigan Paycheck Calculator Smartasset

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Statute Of Limitations For Discovery Of A Payroll Error

Dental Benefits General Faqs Delta Dental Of Michigan

Paycheck Calculator Take Home Pay Calculator

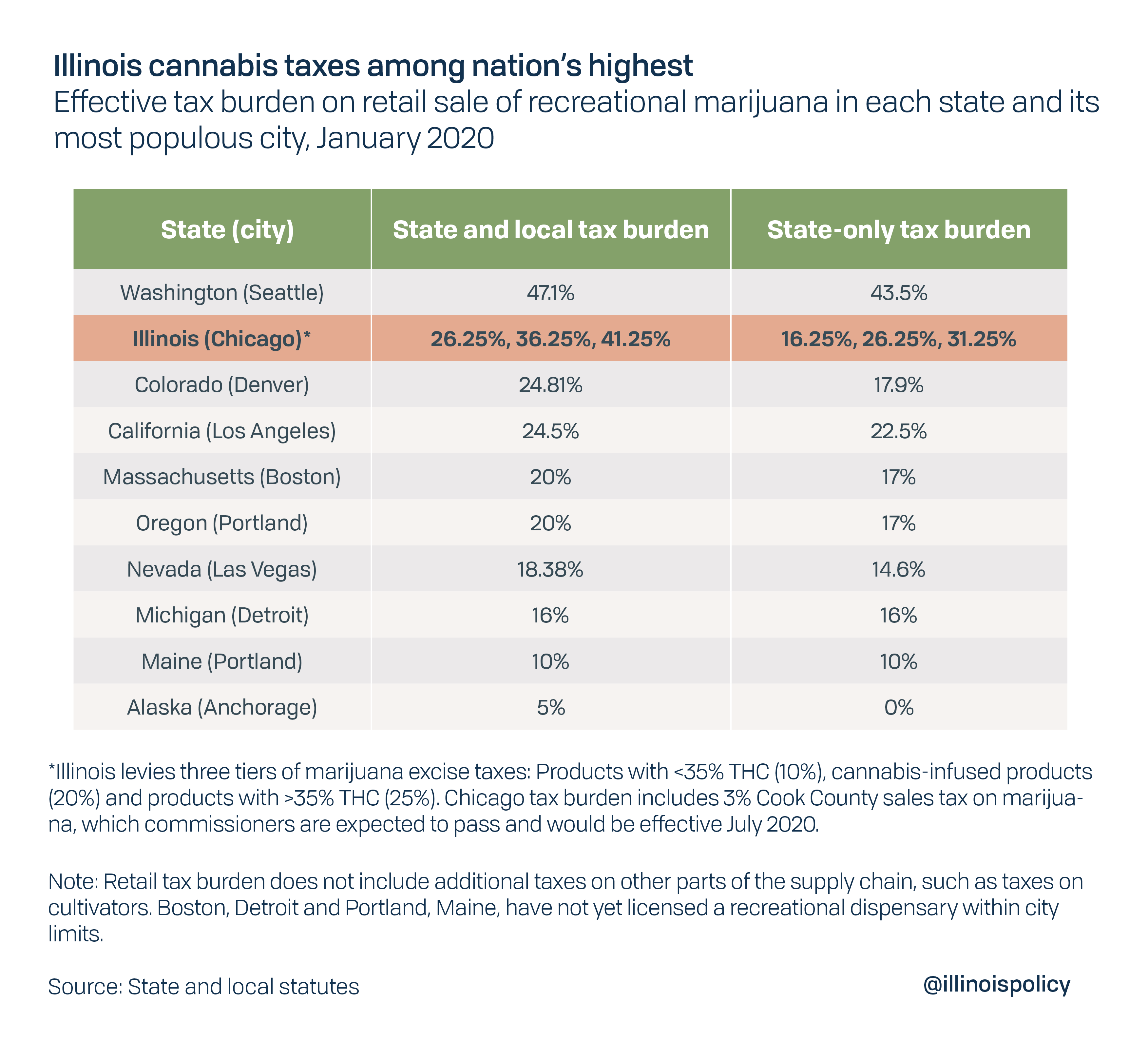

Illinois Cannabis Taxes Among Nation S Highest Could Keep Black Market Thriving

Request And Order For Court Appointed Appellate Counsel Jc 81 Pdf Fpdf Doc

Free Michigan Payroll Calculator 2022 Mi Tax Rates Onpay

Michigan Estate Tax Everything You Need To Know Smartasset

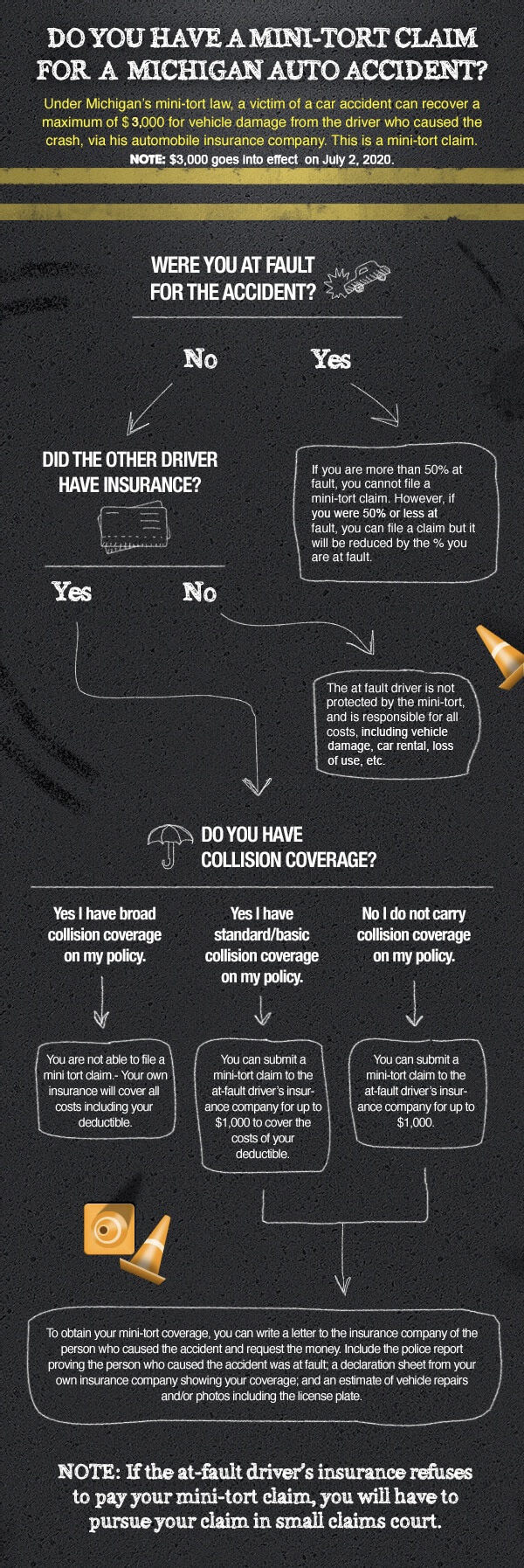

Infographic Do I Have A Mini Tort Claim Michigan Auto Law

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022